Using Loans to Invest in Raw Gemstones

Investing in raw gemstones has always carried an aura of exclusivity. Unlike polished jewels on display at auctions, uncut stones are part of a different financial world—one where banks, investors, and traders operate at the crossroads of mining, global markets, and speculative opportunity. The appeal is clear: raw stones offer margins that finished products often cannot match. But entering this market requires significant capital, precise knowledge, and strategies to reduce risks. That is where loans and financial instruments step in, giving companies and individuals the means to compete in a high-value, high-volatility sector. Understanding how loans function in this niche is crucial for anyone considering entry into raw gemstone investments.

The Appeal of Raw Gemstones as an Investment

Raw gemstones represent potential rather than final beauty. Their value depends on scarcity, quality, and the potential outcome after cutting and polishing. Unlike gold or silver, which are traded in standardized markets, gemstones are unique, and pricing is far less predictable. This uniqueness draws investors seeking diversification and higher returns. Yet it also requires significant upfront capital, because auctions or mining rights for raw stones demand immediate liquidity. Loans allow investors to act quickly when opportunities arise. Without financing, many players would be unable to participate in bidding wars or secure shipments. This dependency on credit has turned banks and lenders into active participants in gemstone markets, providing not just funds but also advisory services and risk management options. For investors, loans transform gemstone trading from a niche opportunity into a structured financial strategy that can be scaled.

Why Banks Enter the Picture

Banks see value in financing gemstones because the collateral is tangible, highly valuable, and—if authenticated—relatively secure. Lenders can structure deals around expected resale values, ensuring they are covered even if the borrower fails to repay. This dynamic makes banks more willing to extend loans for raw stones than for less liquid speculative assets.

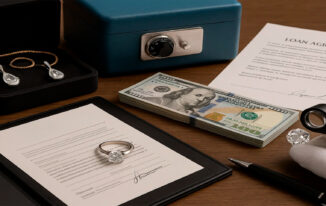

How Financing Works in Practice

Financing gemstone investments is more complex than issuing a standard loan. Banks and specialized institutions often use tailored credit lines structured around auctions, trade cycles, or mining contracts. For example, a borrower might request a short-term loan to secure lots of uncut emeralds at an international auction. Repayment would then be linked to the resale of those stones after cutting and certification. Another common model involves longer-term financing for companies purchasing direct shipments from mines. These arrangements typically include strict documentation, insurance requirements, and oversight to ensure that the collateral retains its value. Unlike traditional lending, gemstone financing often involves joint evaluation by gemologists, insurers, and bankers before deals are finalized.

The Importance of Documentation

Without reliable certification, banks hesitate to extend loans. Documentation proving origin, authenticity, and quality is as important as the stone itself. Disputes over provenance can devalue assets dramatically, leaving lenders exposed. For this reason, financing institutions work closely with industry experts and verification bodies before approving credit lines.

Risks Associated With Loans for Gemstone Investment

No investment in raw stones comes without risks. Market volatility is high, with prices fluctuating based on global demand, fashion trends, and mining output. Borrowers who overextend may find themselves unable to cover repayments if resale values drop. Political instability in mining countries adds another layer of uncertainty, as does the possibility of fraud or misrepresentation. For lenders, the risks include asset devaluation or difficulty in liquidating repossessed stones. Risk management strategies—such as requiring partial collateral outside the gemstones or linking loan terms to insurance guarantees—help reduce exposure. Borrowers must also plan carefully, ensuring that debt obligations align with realistic market projections rather than speculative optimism. Loans can amplify profits but also magnify losses if not managed responsibly.

Market Volatility and Borrowing Pressure

A sudden dip in demand for a particular stone type—say sapphires—can leave borrowers holding expensive assets that cannot be sold quickly. In such cases, loans become burdens rather than tools, making timing and diversification essential strategies.

Strategies for Successful Borrowing

Investors who thrive in gemstone markets usually follow disciplined borrowing strategies. They diversify across different stone types rather than concentrating debt in a single category. They negotiate repayment terms that reflect trade cycles, ensuring that loan schedules match cash inflows from resales. Another strategy involves combining personal equity with borrowed funds, reducing reliance on credit while still leveraging loans for growth. Collaboration with trusted gemologists and legal advisors also strengthens borrower positions, as it demonstrates due diligence to lenders. Above all, successful investors treat loans as tools for measured growth, not as lifelines for speculative bets. This mindset keeps borrowing sustainable even in volatile conditions.

Leveraging Partnerships

Strong partnerships with banks, insurers, and industry experts reduce uncertainty. Lenders are more comfortable extending credit when they see that borrowers have professional support, from valuation experts to logistics providers. This network not only protects investors but also ensures smoother loan approval processes.

The Global Context of Gemstone Financing

Raw gemstone markets are deeply global, with auctions in Geneva, New York, and Hong Kong influencing prices worldwide. Mines in Africa, South America, and Asia supply much of the raw material, often through networks that require international coordination. This global footprint creates both opportunities and challenges for loans. Cross-border financing introduces exchange-rate risks, compliance issues, and varying legal standards. Some banks specialize in gemstone finance precisely because of these complexities, offering clients bundled services that include hedging, compliance management, and global logistics support. For borrowers, choosing lenders with international expertise is critical to avoiding pitfalls in cross-border deals. As demand for precious stones continues to rise in emerging markets, the global nature of gemstone finance will only grow more pronounced.

Cross-Border Legal Challenges

Loans structured across multiple jurisdictions must comply with differing laws on collateral, trade, and debt enforcement. Without careful planning, borrowers and lenders alike can find themselves tangled in disputes that slow transactions and increase costs.

Forward-Looking Perspectives

The future of loans for raw gemstone investments will likely evolve alongside broader trends in finance and technology. Blockchain authentication is already being tested as a way to guarantee provenance and reassure lenders. Digital platforms for trading gemstones may also create more liquid secondary markets, reducing risks for banks. Sustainability and ethical sourcing will become increasingly important, as consumers demand transparency. This could influence loan terms, with banks offering better rates to borrowers who demonstrate compliance with environmental and social standards. On the investor side, more sophisticated financial instruments—such as securitized gemstone funds—may emerge, providing diversification and spreading risk. Loans will continue to play a central role, but their structure will adapt to new technologies, global expectations, and regulatory frameworks. For both borrowers and lenders, the challenge will be to harness innovation while preserving the security and trust essential to such high-value transactions.

Technology’s Role in Reducing Risk

By digitizing verification and tracking ownership history, blockchain tools can minimize fraud and provide lenders with more confidence. As adoption grows, this may reduce interest rates on gemstone loans, making financing more accessible to a wider pool of investors.

Conclusion

Using loans to invest in raw gemstones is a strategy that blends opportunity with complexity. For investors, it provides the capital necessary to enter high-stakes markets and compete for valuable assets. For banks, it represents a chance to back tangible collateral while diversifying lending portfolios. Success, however, depends on careful planning, strict documentation, and clear-eyed recognition of risks. Loans magnify both profits and losses, making discipline and expertise essential. As global markets evolve and technologies reshape authentication and trade, gemstone finance will continue to expand. For those willing to navigate its challenges responsibly, loans can transform gemstone investments from speculative ventures into structured strategies for long-term growth.