Long-Term vs. Short-Term Strategies for Gemstone Investors

Gemstones are more than glittering ornaments—they are financial assets with distinct behaviors in different market cycles. Some investors see them as timeless stores of wealth, much like gold or fine art. Others treat them as speculative instruments, trading quickly to capture price swings at auctions or during inflationary periods. The choice between long-term holding and short-term trading depends on risk appetite, liquidity needs, and broader economic conditions. By comparing both approaches, investors can better understand how gemstones fit into modern financial strategies and decide whether to pursue stability, rapid turnover, or a mix of the two.

How Gemstones Behave in Different Market Conditions

Gemstone prices are shaped by rarity, fashion trends, and the influence of large mining companies that control supply. In periods of inflation, demand for tangible assets like diamonds, emeralds, and rubies rises, pushing prices higher. During stable times, gemstone values grow more slowly, relying on scarcity and cultural appeal rather than speculative demand. Unlike gold, gemstones lack transparent global markets, which means valuations depend heavily on auctions and private deals. For investors, this creates opportunities but also challenges: prices can surge rapidly in the short term yet remain resilient over decades. This dual nature explains why gemstones attract both cautious wealth preservers and opportunistic traders, with strategies diverging sharply between long-term and short-term horizons.

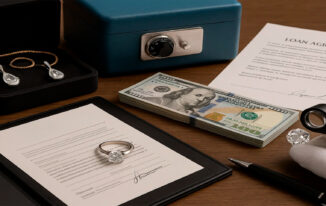

Why Transparency Matters

Because no centralized exchange exists, investors must rely on trusted certification and appraisal. Long-term holders depend on these tools to safeguard value, while short-term traders need them to justify quick resale prices.

Long-Term Strategies for Gemstone Investors

For many, gemstones are ideal for intergenerational wealth. Their compact size, portability, and universal recognition make them appealing as assets that survive currency fluctuations and political instability. Long-term investors usually focus on rare, high-quality stones—top-grade diamonds, untreated sapphires, or Burmese rubies—that are less exposed to fashion shifts. The logic is simple: rarity ensures steady appreciation, while inflation strengthens their role as safe havens. However, long-term strategies require patience. Liquidity is limited, and sales often depend on specialized auction houses. Transaction costs, storage, and insurance also eat into returns. Despite these challenges, gemstones held for decades often perform like “portable real estate”—slow to move but resilient in protecting value.

Long-Term Investment Snapshot

| Advantages | Challenges |

|---|---|

| Preserves wealth across decades | Hard to sell quickly at market value |

| Strong hedge against inflation | High storage and insurance costs |

| Backed by rarity and cultural demand | Dependent on auction markets |

| Ideal for estate planning | Valuation sensitive to certification quality |

Short-Term Strategies for Gemstone Investors

Short-term investors approach gemstones more like traders than collectors. They exploit cycles in demand, such as spikes during inflationary periods, or capitalize on sudden shifts in fashion that make certain stones trend. Auctions are key platforms for this strategy, where buying at one event and selling at another can deliver fast returns. Unlike long-term holders, short-term investors prioritize liquidity and timing. The risks are higher: monopolistic supply control, sudden demand drops, or overbidding at auctions can lead to losses. Still, the potential for rapid gains attracts speculators who see gemstones as volatile but profitable. Success depends on market knowledge, quick decision-making, and access to buyers willing to pay premium prices.

Short-Term Investment Snapshot

| Advantages | Challenges |

|---|---|

| Potential for quick gains | High exposure to volatility |

| Liquidity through global auctions | Frequent transaction fees |

| Flexibility to adjust holdings | Dependent on timing and trends |

| Works well in inflationary cycles | Risk of overpaying in bidding wars |

Balancing Both Approaches

In practice, many investors blend long-term stability with short-term opportunities. A portfolio might include one or two rare stones kept for generational wealth alongside smaller, trend-sensitive gems traded for liquidity. This balance mimics diversified strategies in traditional finance, where bonds provide security and equities provide growth. The key is alignment with personal goals: cautious investors may lean on long-term wealth storage, while risk-tolerant traders use short-term flips to maximize returns. Monopolistic supply practices and inflationary cycles influence both, so flexibility and awareness of global conditions are essential. By mixing horizons, investors reduce exposure to single-market risks while capturing a broader range of opportunities.

How Investor Profiles Shape Strategy

Wealth preservation seekers value patience and rarity, while speculators thrive on volatility and auctions. Understanding which profile fits best is crucial before committing funds to gemstones.

A Narrative Example of Two Approaches

Consider two different investor profiles. One holds a flawless diamond for decades, treating it as a store of value similar to real estate. The stone is insured, certified, and eventually passed down, preserving wealth across generations. The other investor buys a batch of mid-range sapphires during an inflationary cycle, reselling them at auctions within months as demand peaks. Both achieve success, but through different strategies. The first relies on patience and scarcity; the second on timing and liquidity. Together, these examples show how gemstones can fit both long-term wealth preservation and short-term speculation, depending on goals and market awareness.

Forward-Looking Outlook for Gemstone Investors

The gemstone market is entering a new phase. Blockchain authentication is strengthening transparency, reducing fraud, and making both long-term and short-term strategies more secure. Sustainability is reshaping demand, as ethically sourced stones increasingly command premiums. Inflationary pressures are likely to persist in many economies, reinforcing gemstones as hedges. Yet volatility remains a constant, with monopolistic suppliers able to influence markets at will. For long-term investors, these shifts mean greater stability in valuation. For short-term traders, they mean faster-moving opportunities that require sharper timing. The future of gemstone investing will likely remain split between cautious wealth preservation and speculative trading, with success depending on how well strategies adapt to evolving global conditions.

What to Watch

Certification innovations, sustainability premiums, and inflation-driven cycles will shape the balance between long-term storage and short-term trading in the coming decade.

Conclusion

Gemstone investments are neither purely stable nor purely speculative—they sit in the middle, shaped by rarity, inflation, and market control. Long-term investors benefit from slow, steady appreciation and wealth preservation, while short-term traders can seize quick gains during cycles of demand. Both paths have strengths and weaknesses, and the best results often come from blending them. With clearer certification, ethical sourcing, and new financial tools, gemstone markets are becoming more structured, but the basic choice remains: patience for stability or agility for opportunity. Knowing when to act—and for how long—is what makes gemstone investing both challenging and rewarding.