How To Choose A Favorable Loan: What To Pay Attention To

Loans may look simple on the surface, but the details behind the contract decide whether they become helpful or burdensome. Lenders advertise attractive rates, yet the real cost often hides in commissions, insurance requirements, and rigid repayment structures. Borrowers who look only at the nominal rate risk paying far more than expected. Choosing a favorable loan means comparing every element—effective rates, fees, repayment options—and understanding how they work together. The goal is not only to minimize cost but also to find conditions that support financial stability and flexibility.

Why Careful Comparison Matters

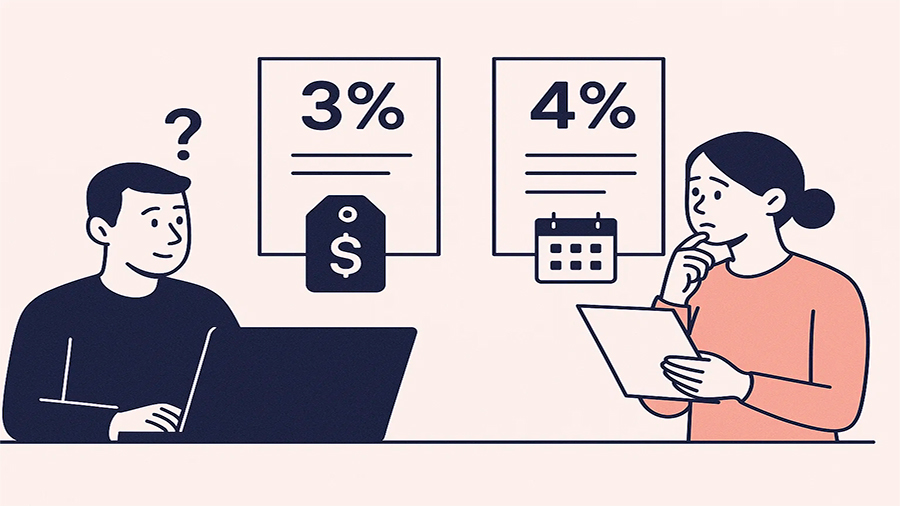

Two loans can look similar in marketing material but produce very different outcomes. A low nominal rate might come with added commissions or mandatory insurance that raises the effective cost. Another offer, with a higher advertised rate, might actually be cheaper once the numbers are calculated. Careful comparison ensures that borrowers are not misled by headline figures. A favorable loan balances total cost with terms that suit the borrower’s income and needs. Without this diligence, what seems like a good deal can turn into years of unnecessary repayment stress.

Nominal Versus Effective Rates

The nominal rate is the percentage shown in ads. The effective rate, or APR, includes fees, insurance, and commissions. It is the true measure of cost. Borrowers who ignore it underestimate the burden of repayment. Always ask for the effective rate in writing, and use it as the key point of comparison across lenders.

| Loan Element | Why It Matters | What To Check |

|---|---|---|

| Nominal Interest | Advertised rate, not the full picture | Compare but don’t rely on it alone |

| Effective Rate (APR) | Reflects real cost of borrowing | Request a full breakdown |

| Commissions | Adds one-off or recurring costs | Look for opening and annual fees |

| Insurance | Often obligatory, increases cost | Check necessity and alternatives |

Key Factors That Shape Loan Favorability

When choosing a loan, four main aspects determine favorability: the effective rate, commissions, insurance obligations, and repayment terms. Each one carries weight, and ignoring any of them risks overpaying. Sometimes a slightly higher rate becomes the smarter option if it comes without hidden fees. Sometimes flexibility in repayment matters more than initial cost. The winning strategy is to evaluate the loan as a whole rather than focusing on one attractive feature.

Effective Interest Rate

The most critical number to check. It includes all additional costs, not just the advertised rate. Comparing loans without this figure is misleading.

Commissions

Opening commissions, monthly account fees, and closing charges can make a loan more expensive than expected. These need to be factored into overall affordability.

Insurance

Life or job-loss insurance is often bundled with loans. While it can provide security, it also inflates the effective rate. Borrowers must decide whether the coverage is valuable or redundant.

Repayment Conditions

The structure of repayment influences long-term costs. Favorable loans allow early repayment without penalties, offer grace periods when necessary, and match repayment schedules with income flow. Rigid contracts with penalties may look cheaper upfront but end up costing more.

Comparing Approaches

Real borrowing situations highlight how different factors shift outcomes. One scenario involves choosing between a low-interest loan with hidden fees and a slightly more expensive loan with transparent conditions. Another shows the value of flexible repayment over the smallest possible rate. These comparisons reveal that favorable loans are not always the cheapest-looking on paper but those that fit real financial behavior and stability.

The Hidden Cost Loan

A borrower selects a loan with the lowest advertised interest. Only later do they discover added commissions and insurance requirements. The effective rate turns out significantly higher than expected. Another loan, with a higher nominal rate but no extra costs, would have been cheaper overall. This scenario shows why focusing only on the headline number is dangerous.

Flexibility Versus Cost

Another borrower chooses a loan with a slightly higher rate but no penalties for early repayment. When their income improves, they repay the loan years earlier than planned, saving large amounts in interest. A loan with stricter conditions would have forced them to pay the full term. Flexibility proved more valuable than a marginally lower rate.

The Insurance Factor

A borrower compares two renovation loans. One has a lower rate but obliges the purchase of expensive insurance, driving up monthly costs. The other has a higher nominal rate but no insurance requirements. The second loan becomes more affordable in practice. This case illustrates how insurance clauses shift the balance between offers.

Scenario Four: Grace Periods In Practice

In situations where income is irregular, a borrower may benefit from a loan with lenient grace periods. Although the interest is higher, the contract allows temporary delays without severe penalties. This prevents defaults and stress, showing how repayment structure can outweigh pure cost considerations.

| Scenario | Key Decision | Outcome |

|---|---|---|

| Hidden Costs | Focused only on low nominal rate | Ended up with higher effective rate |

| Flexibility | Chose prepayment option | Saved interest with early repayment |

| Insurance | Avoided bundled policy | Lower monthly expense |

| Grace Periods | Selected contract with flexibility | Managed irregular income better |

Psychological And Lifestyle Factors

Loans affect more than budgets—they influence daily peace of mind. Contracts with hidden costs or strict penalties create constant stress. Transparent, flexible agreements make repayment easier to manage and allow borrowers to focus on life rather than debt. A favorable loan is one that fits both numbers and lifestyle. Borrowers should consider whether terms align with income stability, future goals, and tolerance for risk. The most favorable contract is one that provides confidence rather than worry.

Checklist Before Signing

Before committing to any loan, always ask: What is the effective rate? What commissions apply? Is insurance mandatory? Can I repay early without penalties? What happens if I miss a payment? Clear answers to these questions reveal whether the loan is genuinely favorable or simply marketed as such.

The Conclusion

Not all loans are created equal. The difference between a good loan and a costly one lies in the details—effective rates, hidden fees, insurance obligations, and repayment terms. Real-world borrowing situations show that the most favorable option is not always the one with the lowest rate, but the one that matches the borrower’s financial reality and provides flexibility. Careful comparison and clear questioning turn loan offers from potential traps into useful tools for building stability and reaching goals.