Financing The Storage And Certification Of Jewellery After Auction

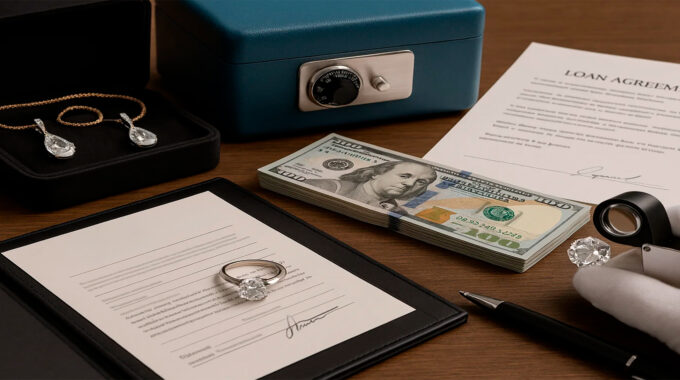

Winning jewellery at auction is only the beginning of ownership. Rare diamonds, vintage watches, or signed pieces from legendary houses don’t just sit in drawers or boxes. They require professional storage, insurance, and certification to protect both their value and provenance. These services can be expensive, and for many collectors, arranging loans is a practical solution. Financing storage and certification may not sound glamorous, but it is a crucial part of responsible collecting. Without these steps, a prized stone can lose market value, or worse, become impossible to resell. Understanding how loans fit into this process helps buyers protect their investments after the hammer falls.

Why Financing Matters After Auctions

Buying jewellery at auction already stretches budgets. Many collectors borrow just to secure the winning bid, leaving little liquidity for the next steps. But storage and certification are not optional. Auction houses often provide temporary custody, but long-term security rests with the buyer. Certification by gemological institutes verifies authenticity, while high-security vaults ensure protection from theft or damage. Both services add significant costs, sometimes thousands of dollars annually. This is where loans come in. Short- and medium-term financing allows buyers to spread costs, safeguard assets, and maintain liquidity for other ventures. Rather than delaying certification or compromising on security, financing creates a smoother transition from purchase to preservation. The balance lies in choosing the right product for the situation and ensuring repayment aligns with broader financial goals.

The Real Risk Of Skipping Costs

Some buyers try to cut corners by delaying certification or storing jewellery at home. These choices can backfire quickly. Without certification, resale opportunities shrink. Without proper storage, insurance premiums skyrocket. In worst cases, loss or damage erases value entirely. Loans provide a bridge to cover these essential but unglamorous expenses.

| Post-Auction Step | Why It Matters | Loan Role |

|---|---|---|

| Certification | Authenticates jewellery, confirms provenance | Finances fees at gemological institutes |

| Storage | Protects against theft and damage | Covers vault or custodial costs |

| Insurance | Secures compensation in case of loss | Funds premium payments until liquidity returns |

Loans For Certification: Validating Value

Certification is often the first step after acquisition. Institutions like GIA or HRD Antwerp provide documentation that confirms authenticity and grade. Without this, resale markets and insurers discount jewellery heavily. Certification fees vary based on size and complexity, but they can add up quickly when multiple stones are involved. For collectors already stretched by auction prices, loans cover these immediate expenses. Short-term loans, often structured as credit lines or unsecured personal loans, are most common. The repayment period usually aligns with the time needed to complete certification and resell or refinance the item. For investors, this step is less about passion and more about protecting asset liquidity. Without certification, jewellery sits as a risky asset. With certification, it becomes recognized collateral or tradeable investment.

Collector In Paris

A collector who bought an Art Deco sapphire ring at auction financed the certification through a bank credit line. The modest loan allowed her to authenticate the piece with GIA, increasing its resale potential by 20%. The added value outweighed the financing cost, showing how borrowing strategically can preserve and even enhance investment outcomes.

| Loan Product | Typical Use | Repayment Period |

|---|---|---|

| Personal Loan | Certification fees for single pieces | 6–12 months |

| Credit Line | Ongoing certification of multiple purchases | Flexible, revolving |

| Secured Loan | High-value collections, multiple certifications | 1–3 years |

Loans For Storage: Security First

Jewellery doesn’t just need to be locked away—it needs specialized storage that meets insurance standards. Vaults in financial districts, custodial services, and bonded warehouses are standard choices. These facilities charge fees that range widely based on security level and location. Some collectors include insurance within storage contracts, adding another layer of cost. Loans bridge this gap, especially for those juggling multiple acquisitions or seasonal cash flow shortages. Medium-term loans are often preferable here, since storage is a recurring expense rather than a one-off cost. By financing storage, buyers ensure compliance with insurers and protect the resale value of their jewellery without straining liquidity.

Dealer In Hong Kong

A Hong Kong dealer specializing in jadeite auctions financed vault fees for three years through a medium-term bank loan. This allowed him to hold stones securely until market demand rose. By the time he sold, prices had increased by 15%, and the loan had paid for itself. The case shows that financing storage can function as an investment in timing as much as security.

| Storage Option | Annual Cost Range | Best Loan Match |

|---|---|---|

| Private Vault | $500–$2,000 | Personal loan or credit card |

| Custodial Bank Service | $2,000–$10,000 | Medium-term bank loan |

| Bonded Warehouse | $10,000+ | Secured commercial loan |

Insurance: The Overlooked Expense

Insurance is usually mandatory for certified and stored jewellery. Premiums scale with valuation, meaning that rare pieces require significant outlays. Many collectors underestimate this cost, only to find that it eats into liquidity. Loans can cover premiums in the early years, particularly when pieces are acquired as long-term investments. While this adds another layer of repayment, it ensures continuity of coverage. Without insurance, a single theft or loss can destroy the value of an entire collection.

The Intersection Of Storage, Certification, And Insurance

Certification increases insurable value, storage meets underwriting requirements, and insurance guarantees financial recovery. These three pillars are intertwined, and financing one often means financing all. Loans allow buyers to coordinate these steps without delay, ensuring that investments transition smoothly from auction lots to secure, recognized assets.

Risks Of Relying On Loans

While loans open doors, they also create obligations. If jewellery prices fall, debt may outweigh asset value. If collectors overextend, repayment schedules can strain liquidity. Borrowing should never replace planning. Loans are tools to bridge gaps, not excuses to overbid at auctions without considering long-term costs. Experienced buyers calculate storage, certification, and insurance before bidding, ensuring they know total ownership costs. New collectors often overlook these expenses, only to scramble afterward. Responsible financing balances passion with pragmatism.

Managing Loan Risk

One strategy is to limit borrowing to essential services like certification and storage, while paying insurance directly from savings. Another is to use secured loans, which often carry lower interest rates, reducing long-term financial strain. Transparency with lenders also helps—explaining that funds are tied to insured, certified assets can improve terms.

The Conclusion

Winning jewellery at auction is a thrilling moment, but the story doesn’t end with the gavel. Certification, storage, and insurance shape whether that piece becomes a lasting investment or a risky liability. Loans provide practical ways to manage these costs, keeping assets secure and market-ready. From Parisian collectors financing certification, to Hong Kong dealers covering vault costs, case studies show how borrowing strategically protects long-term value. Used wisely, loans transform post-auction expenses into manageable steps. Used carelessly, they can turn triumph into financial strain. For collectors, success comes not just from acquiring rare stones, but from financing their safekeeping responsibly.