Borrowed Investments Versus Savings: Case Studies Of Winning Strategies

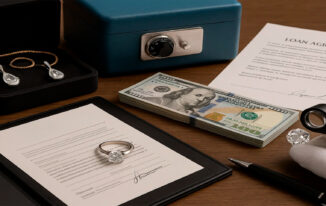

Every investor faces a fundamental choice: use existing savings or borrow funds to chase opportunities. In the world of precious metals—gold, silver, platinum, and palladium—the decision carries serious weight. These assets are attractive because they hold value in uncertain times, but they don’t generate income like stocks or real estate. The way you finance the purchase can dramatically change the outcome. Some investors build positions slowly, paying in cash. Others use credit, amplifying both gains and risks. By looking at case studies of both approaches, we can see how strategy, timing, and discipline shape results.

The Core Question: Borrow Or Save?

Savings-driven investing comes with stability. You buy only what you can afford, without repayment schedules or interest. Borrowed investing, however, introduces leverage—an ability to own more metal than your savings allow. In a rising market, leverage magnifies returns. In a falling market, it multiplies losses. The decision depends on your tolerance for risk, your view of the market, and your ability to handle debt obligations regardless of price fluctuations. The stories of different investors show that neither method is universally better. Instead, the winning strategy comes down to aligning financing with circumstances. What worked for one person in one economic climate can fail for another in a different context. These case studies illustrate the contrast.

The Stability Of Cash-Only Buying

Cash buyers avoid the stress of loan repayments. When prices drop, they can wait for recovery rather than liquidating to meet deadlines. Their discipline is patience. Savings-driven strategies suit long-term investors who see metals as insurance rather than speculation. But they also limit scale: if you save slowly, you build positions slowly, which means missing out on larger profits in bull markets. The trade-off is security versus growth potential.

The Patient Saver

Emma, a schoolteacher in Canada, built her gold portfolio over a decade. She set aside part of her salary each month, buying coins whenever she reached a threshold. By 2020, she had accumulated enough to benefit when gold surged during the pandemic. Her holdings doubled in value compared to her original savings. Because she used no credit, she faced no stress when prices dipped in 2015. Emma’s story shows the power of patience. She never risked default, and while her gains were gradual, they were steady and secure. For people who prefer safety over speed, her method stands as a strong example of long-term strategy paying off.

Lessons From Emma

The key was discipline. By treating her gold purchases as savings rather than speculation, Emma created resilience. She had no deadlines, no lenders, and no worries about market timing. When conditions improved, her patience translated into profit.

The Borrower Who Won Big

Contrast this with Raj, a trader in Mumbai. In 2018, he borrowed aggressively to buy silver, convinced industrial demand would rise. He took a bank loan with a fixed repayment plan, betting prices would climb within two years. His gamble paid off—by 2021, silver prices surged, and his profits far outpaced his loan costs. Borrowing allowed him to control more silver than his savings alone would have supported. For Raj, the strategy worked because he timed the market well and had the income stability to service the loan. His case shows that leverage can amplify success, but it requires precision and confidence.

What Made Raj Different?

Raj’s win wasn’t luck alone. He studied market signals, secured a loan with manageable interest, and ensured he could repay regardless of short-term volatility. His story highlights the advantage of pairing risk with preparation. Borrowed funds gave him an edge, but his discipline kept him safe.

When Borrowing Backfires

Not every borrowing story ends well. In 2013, Lucas, an investor in Brazil, took out a loan to buy platinum. He expected rising automotive demand to push prices higher. Instead, the market slumped. Loan repayments quickly outweighed his income from other sources. To meet obligations, he was forced to sell at a loss. The debt remained long after his metals were gone. Lucas’s experience underscores the danger of borrowing without backup plans. Markets are unpredictable, and loans don’t pause for downturns. His case reveals the dark side of leverage: what looks like opportunity can turn into years of financial stress.

The Debt Trap

Lucas underestimated risk. He lacked flexibility and entered with too much optimism. The lesson here is that borrowing amplifies both directions. Without buffers, even smart ideas can unravel under debt pressure.

Comparing Borrowed And Savings Strategies

The case studies show two extremes: patience rewarded and borrowing gone wrong. In reality, most investors blend both methods, using savings for core holdings and borrowing selectively during high-confidence opportunities. The crucial difference lies in how risk is managed. Cash buyers trade speed for peace of mind. Borrowers trade stability for potential acceleration. Each method has merit if aligned with personal financial stability and market conditions.

| Approach | Advantages | Risks |

|---|---|---|

| Savings-Based | Stable, no debt pressure, long-term security | Slow growth, limited exposure |

| Borrowed Funds | Larger exposure, faster gains in bull markets | Repayment stress, amplified losses in downturns |

Blended Strategies: A Middle Path

Many successful investors find balance by using both. They treat savings as the foundation—slow, steady, reliable—and loans as tactical tools. For example, a business owner might build a long-term gold reserve using profits, while borrowing selectively to capture short-term silver surges. This hybrid method spreads risk. If the borrowed bet fails, the savings cushion remains intact. If it succeeds, returns multiply. Blended strategies require discipline to prevent borrowing from overshadowing the stable base. Without restraint, it’s easy to slide from balance into overexposure.

Examples Of Blended Approaches

A farmer in Australia used profits from crops to slowly buy gold coins over years, while borrowing small amounts during peak seasons to speculate on silver. Even when silver trades didn’t always succeed, his gold holdings gave him security. Another example is a European family office that holds core savings in physical gold but uses credit lines for short-term trades in platinum. These examples show the flexibility possible when both tools are used together responsibly.

Psychological Differences Between Borrowers And Savers

Beyond financial outcomes, psychology matters. Savers often describe feeling calm, knowing they own metals outright. Borrowers describe a mix of thrill and pressure, living with the knowledge that debt hangs over them. This psychological strain can influence decision-making, sometimes pushing borrowers into risky behavior or rash exits. Conversely, it can also sharpen focus, forcing them to monitor markets more closely. The mental side of investing is rarely discussed, but it is one of the clearest distinctions between strategies.

The Emotional Factor

Emma could sleep peacefully through downturns, confident her savings-backed gold was secure. Raj admitted to losing sleep in volatile months, but said the pressure kept him sharp. Lucas, by contrast, described anxiety and regret that lingered long after his losses. These stories remind us that investing is not purely about numbers—it is also about how strategies fit human resilience and temperament.

Lessons For Modern Investors

Today’s investors face more volatile markets, with geopolitical tension and climate risks influencing metals. In such times, the question of whether to borrow or save is even more relevant. The lessons from case studies are clear. Use savings to build resilience. Borrow only with clear repayment plans and high confidence in timing. Avoid debt traps by keeping borrowed exposure small relative to core holdings. And most importantly, align strategies not only with markets but with your own ability to handle stress. Winning strategies are as much about fit as about fortune.

The Conclusion

Borrowed investments and savings strategies each offer unique paths. Savings give security, slow growth, and peace of mind. Borrowing delivers leverage, potential speed, and amplified stakes. Case studies show both victories and defeats, proving no strategy is foolproof. The real winning strategies are those that match financial stability with personality, blending caution and ambition in ways that survive downturns and seize upswings. In the world of metals, the smartest investors know that it isn’t just about owning gold or silver—it’s about choosing the right way to finance those dreams.